- DeFion Labs

- Posts

- Unveiling PayPal's Stablecoin: Centralization and Asset Freeze Concerns

Unveiling PayPal's Stablecoin: Centralization and Asset Freeze Concerns

Centralization, Asset Freeze Concerns, and the Future of Financial Control

GM Defions,

PayPal's Stablecoin: The Centralization Conundrum

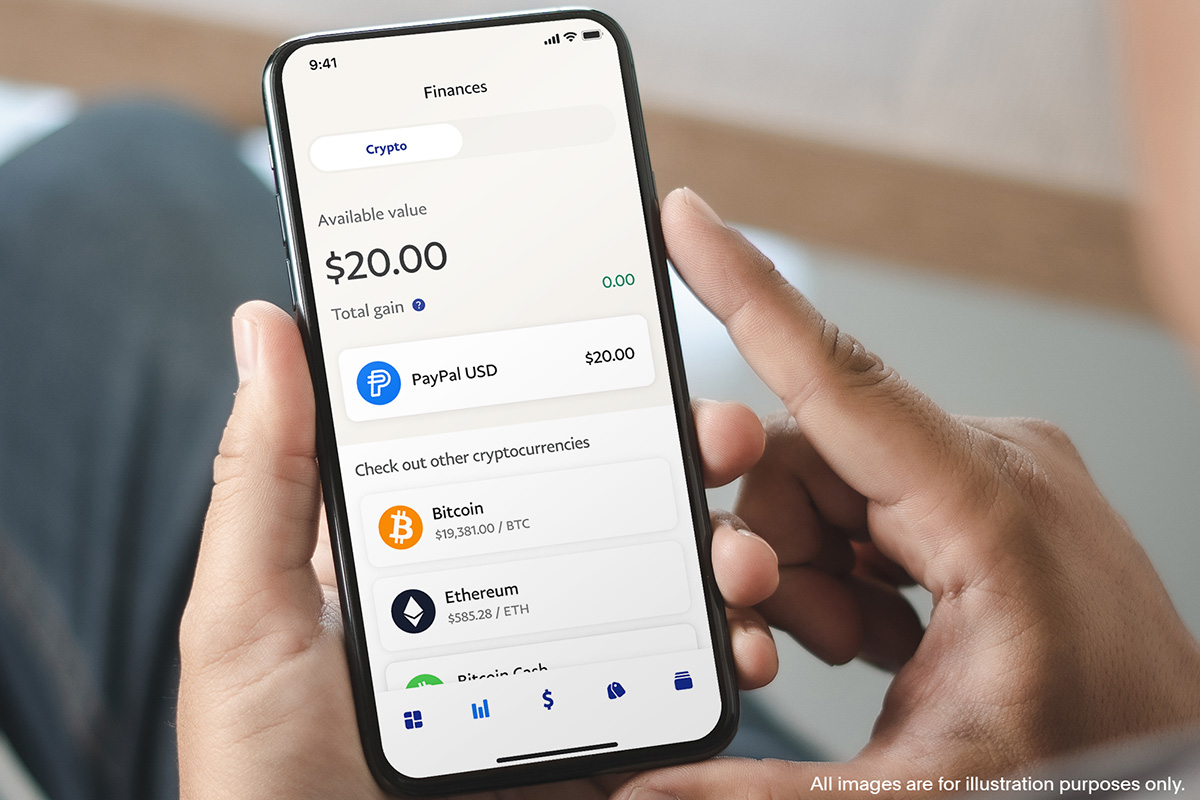

The entry of major players like PayPal into the cryptocurrency space has generated both excitement and skepticism. One significant development has been PayPal's introduction of a stablecoin, aiming to provide users with a more stable digital currency for transactions and savings. While this move might seem promising, it's important to understand the underlying dynamics.

Unlike traditional cryptocurrencies like Bitcoin and Ethereum, which operate on decentralized networks, PayPal's stablecoin is centralized. This means that the control and management of the stablecoin rest in the hands of PayPal, giving them considerable authority over the currency's functionality, distribution, and policies.

Asset Freeze: A Looming Concern

One of the most crucial aspects to consider when dealing with centralized stablecoins is the potential for asset freeze. Due to their centralized nature, entities like PayPal have the ability to freeze user accounts or assets, citing various reasons such as regulatory compliance, security concerns, or suspicion of fraudulent activities.

While centralized control can enhance security and regulatory compliance to some extent, it also poses a significant risk to users' financial autonomy. Imagine a scenario where your assets are frozen unexpectedly, leaving you unable to access or utilize your funds. This possibility raises important questions about the decentralization ethos that underpins many blockchain projects.

Navigating the Centralization Tightrope

As PayPal's stablecoin gains traction, users and investors need to strike a balance between convenience and control. While centralized systems can offer seamless transactions and user-friendly interfaces, they also come with a trade-off in terms of control and independence.

For those who prioritize the core tenets of decentralization, alternatives such as decentralized stablecoins built on blockchain networks might be more aligned with their beliefs. These alternatives offer the potential for peer-to-peer transactions without the centralized control that PayPal's stablecoin entails.

Final Thoughts

The introduction of PayPal's stablecoin highlights the ongoing tension between centralized and decentralized financial systems within the cryptocurrency landscape. As investors and users, it's crucial to remain informed about the nuances of each offering and make choices that align with your values and priorities.

We will continue to explore diverse topics related to cryptocurrencies, blockchain technology, and the evolving financial ecosystem. Stay tuned for expert analyses, regulatory updates, and insights to help you navigate this exciting and ever-changing landscape.

Stay vigilant, stay empowered.

Warm regards,

The Defion Labs